How to Master Financial eLearning Design

Finance eLearning Content Development: Designing Scalable eLearning Finance Courses and Certificate Programs for Professional Training

Introduction on How to Master Financial eLearning Design

The digital transformation has transformed the way financial knowledge is manufactured, distributed and consumed within organizations and institutions of learning. Formal classroom-based learning is being augmented and in numerous instances substituted by structured online learning facilities which provide scalability, flexibility and quantifiable results. The heart of this transformation is the so-called finance elearning content development, the field of study that entails integrating financial knowledge, instructional design, and technology to achieve successful learning experience. Out of corporate upskilling programs to professional certification programs, the well-designed e learning finance courses have become hugely important in the development of the workforce and life-long learning.

The article is dedicated to the strategic and practical aspects of finance oriented digital learning, describing the way in which e learning certificate courses, e learning training courses, and e learning accounting courses are created, implemented, and applied to facilitate professional competence in the contemporary financial settings.

1. The Strategic Importance of Finance eLearning Content Development

1.1 Why Digital Finance Education Matters

Finance is a field that keeps on changing because of the regulatory change, technological advancement, and market dynamics. Finance elearning content development allows organizations and education providers to revise course material effectively and deliver it in a consistent manner across geographies. Compared to textbooks that are not constantly changed or frequent classes, the digital content can be edited, separated, and reposted with little disturbance.

This flexibility in the professional environment helps in achieving compliance training, development of technical skills and leadership. An example is where a multinational company could implement standardized financial training programs to regional financial departments so that there can be uniform interpretation of accounting policies and financial policies.

1.2 Aligning Learning Outcomes With Business Objectives

The development of an effective finance elearning content starts with the proper alignment of the learning outcome and the business or professional outcome. The courses are structured in a way that does not only pass information, but develop applied skills of financial analysis, budgeting, valuation, and interpretation of regulators. This is an outcome-oriented approach, which means that learners should be able to apply the acquired knowledge in the workplace performance.

The eLearning content of finance is usually associated with the performance indicators, career ladder, or certification standards in the corporate environment and supports its strategic importance.

2. Designing High-Quality e Learning Finance Courses

2.1 Structuring Content for Digital Delivery

The properly constructed e learning courses on finance are designed in such a way that they promote incremental learning. Basic concepts are explained, and the next stage is practical examples, case study, and simulation in a scenario. Such sequencing parallels the career development of professional finance practitioners who are transferred between theory and practice.

Cognitive load also should be put into careful consideration when it comes to digital delivery. Sophisticated financial issues like cash flow modeling, financial reporting or risk analysis have to be divided into manageable modules without simplifying information. Effective content development of finance elearning is neither too technical nor too simplistic to keep the learners interested.

2.2 Integrating Real-World Financial Context

The inclusion of real world examples is one of the best ways of improving e learning finance courses. Corporate finance, banking or investment management, or public sector finance Case studies Case studies assist the learner in putting abstract ideas in context. An example of this is a financial statement analysis module which can involve examples involving the publicly listed companies or simulated management reports.

This practical based method reinforces the memory of knowledge and promotes its practical use in work.

3. The Role of e Learning Certificate Courses in Professional Development

3.1 Certification as a Credibility Signal

The use of e learning certificate courses in the process of certifying professional competence has gained prominence. The certificates indicate that learners have achieved organized training, have acquired knowledge and have passed certain assessment standards. Certification is an important addition to the credibility and accuracy that are also of paramount importance in finance.

Those professionals who aim to advance their careers tend to choose courses on e learning certificates to formalize skills in areas that include financial modeling, accounting standards, corporate finance, or risk management. In turn, employers consider such credentials as a sign of the desire to engage in the process of lifelong learning.

3.2 Assessment and Verification in Digital Environments

Good quality e learning certificate courses include strict course assessment techniques. They can be quizzes, practical work, analysis of scenarios, and final exams that can test the applied knowledge instead of rote learning. Assessment design plays a significant role in developing e-learning content in the financial field so that certification can be a true indicating factor of actual ability.

It is also through digital platforms that learner progress and performance can be tracked and transparency is created to both the learners and the sponsoring organizations.

4. e Learning for Training in Corporate and Institutional Settings

4.1 Scaling Financial Training Across Organizations

Online training has gained popularity as an e learning course to organizations which are interested in the need to scale efficiency in finance education. The problem of having different teams with different levels of financial literacy is typical of big organizations that have to train their staff. Online training programs can be customized to follow various career trajectories, such as non-finance managers to top finance experts.

With the use of centralized content deployment, organizations are able to have consistent messages regarding financial policies, controls and reporting requirements. This uniformity decreases operational risk and improves governance.

4.2 Measuring Training Effectiveness

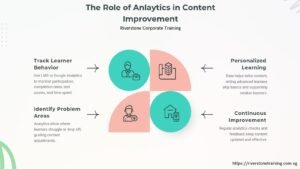

The ability to measure the outcomes is one of the benefits of e learning for training. Learning management systems give information on the completion rates, performance in assessment, and the level of engagement. These insights enable companies to improve content and note any shortcomings of their employees.

Such measurement is especially useful in training on a financial related topic, since it ties learning programs with compliance, performance enhancement and strategic implementation.

5. Specialized e Learning Accounting Courses

5.1 Addressing the Complexity of Accounting Education

Accounting is a profession that is technical and demands accuracy, reliability, and excellent knowledge of standards and principles. The level of e learning accounting courses is specifically applicable to this field due to the ability of the learner to learn at his own pace, review challenging areas, and solve problems repeatedly.

Financial reporting, management accounting, the fundamentals of auditing and regulatory frameworks are usually part of the digital accounting course. Finance elearning content development using structured modules and worked examples can make sure that the learners acquire the ability to master the complex rules and apply them properly.

5.2 Supporting Compliance and Regulatory Updates

The accounting standards and regulations change on a regular basis. The accounting e learning courses allow contrived modification of course material so that learners can always be abreast with the current requirements. It is especially relevant to the professionals who operate under the jurisdiction-specific regulations, on one hand, or under the policies of the international financial reporting frameworks, on the other hand.

The companies employ online accounting training to ensure teams operate with the latest standards to minimize the chances of errors in reporting or violation of regulations.

6. Technology and Pedagogy in Finance eLearning Content Development

6.1 Leveraging Digital Tools and Platforms

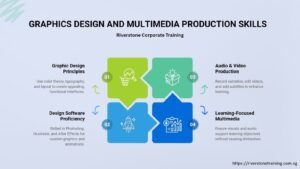

A variety of online tools, such as learning management systems, interactive simulations, and multimedia content, are exploited in the development of modern finance elearning content. Interactive spreadsheets, videos, and simulation of a scenario facilitate different learning types.

In the case of finance, online interactive models and calculation software can be of great use, as this lets the learner try out assumptions and see their results in a dynamic manner.

6.2 Instructional Design Principles for Finance Education

Effective e learning finance courses are based on strong instructional design. This involves well defined learning objectives, logical progression of the content, engagement of active learning and frequent reinforcement of important ideas. Instructional designers work with finance subject matter experts so that they bring accuracy but still remain effective pedagogically.

This partnership is key to the best finance elearning content development since it facilitates a compromise between technical skills and education best practices.

7. Long-Term Value of Digital Finance Learning

7.1 Supporting Lifelong Learning in Finance

The financial world is changing very fast and therefore life long learning is a necessity. Online degree programs and modular digital courses come with e learning certificate courses which enable professionals to refresh their competencies, as they may be required to do. Students are able to develop learning portfolios throughout their careers, and include new certifications and competencies as their job descriptions advance.

The flexibility improves career resilience and promotes career development.

7.2 Organizational Impact and Talent Development

Organizationally, training in e learning is a strong talent pipeline and succession planning. The finance teams that are empowered with the latest knowledge and analytical skills are better placed to play an important role in strategic decision-making and risks management.

In the long term, the regular investment in the development of finance elearning content leads to the development of the culture of learning, high standards of accountability, and analytic rigor.

Conclusion

The development of finance elearning content has become a staple of the contemporary professional education, allowing scalable, flexible and outcome-driven learning in the financial fields. Professionals acquire practical skills through the e learning finance course designed well which is directly transferred to their performance in the workplace. E learning certificate courses are competence formally recognized, and e learning as a means of training aids building the capabilities of organizations at scale. Degree courses in e learning accounting focus on technical profundity needed to be compliant and financially sound. With the ongoing transformation of the field of finance, digital learning will still be a crucial resource in the creation of competence, relevance, and sustainable professional and organizational achievement.